When two people decide to live together — whether as roommates, partners, or in any shared household arrangement — one of the first financial questions they often face is how to split the rent. If both people earn similar incomes, splitting rent evenly might feel straightforward. But what happens when one person makes significantly more than the other?

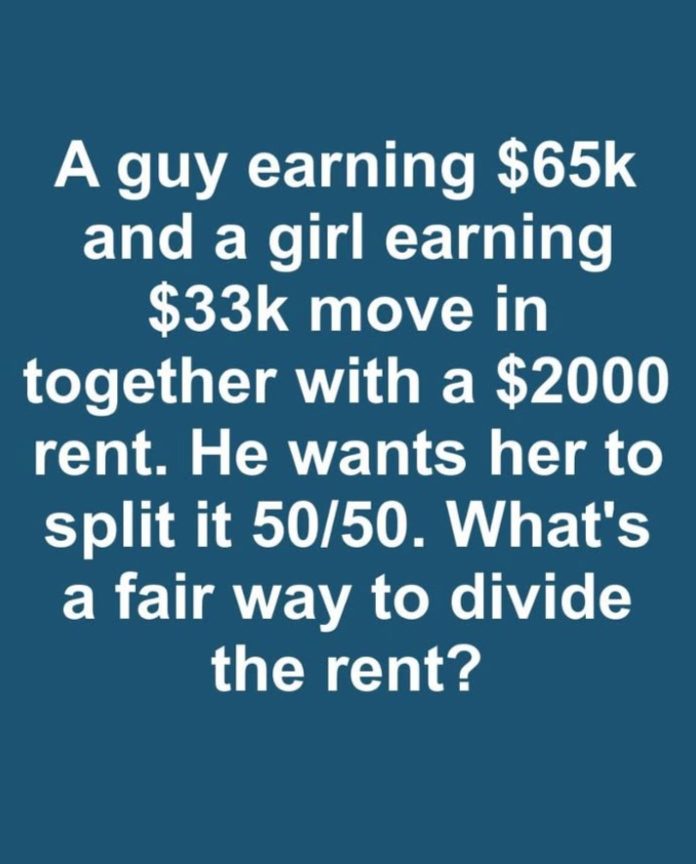

This situation comes up often. For example, imagine one person earns $65,000 per year and the other earns $33,000, and they are planning to share a rental with $2,000 in monthly rent. If they simply split the rent 50/50, the lower-earning person ends up spending a much larger share of their income on housing than the higher-earning person. That can lead to resentment, financial strain, or a sense of imbalance in the relationship.

Because housing is typically the largest monthly expense for most people, how rent is divided can have a meaningful impact on financial well-being, stress levels, and the health of the partnership. It’s worth taking time to explore fair options rather than assuming a straight 50/50 split is the only choice.

In this article, we’ll explore several approaches to dividing rent fairly when incomes differ — along with the reasoning behind each method — so that you can choose an arrangement that feels balanced and respectful for everyone involved.

Why a Straight 50/50 Split Can Feel Unfair

Splitting rent equally means each person pays the same flat amount regardless of income. At first glance, this seems simple and even. However, because people don’t make the same amount of money, equal payments don’t always translate into equal financial impact.

To illustrate this, consider two people sharing a $2,000 monthly rent:

- Person A earns $65,000 a year

- Person B earns $33,000 a year

If they split rent 50/50, each pays $1,000 per month. For the higher earner, this represents a reasonable portion of their income. For the lower earner, $1,000 per month consumes a much larger percentage of their take-home pay, which means they may struggle to cover other essentials like food, utilities, transportation, or savings.

Because of this imbalance, many people look for alternatives that reflect the difference in income more fairly. The idea isn’t to “punish” the higher earner, but to distribute financial responsibilities in a way that feels equitable and sustainable for both parties.

Approaches to Fairly Dividing Rent

Below are several common methods couples or roommates use to divide rent fairly when incomes are unequal. Each has its advantages, and the right choice depends on your comfort level, financial goals, and communication style.

1. Proportional to Income

This method divides rent based on how much each person earns relative to the total income of both people. It ensures each person pays a portion of rent that is proportional to their ability to pay.

How it works:

- Add both incomes together:

$65,000 + $33,000 = $98,000 total income - Determine each person’s share of that total:

- Person A’s share: $65,000 ÷ $98,000 ≈ 66%

- Person B’s share: $33,000 ÷ $98,000 ≈ 34%

- Apply those percentages to the rent:

- Person A pays 66% of $2,000 → $1,320

- Person B pays 34% of $2,000 → $680

This approach ensures that each person contributes roughly in proportion to what they make. It often feels fair because neither person is paying more than their share relative to income.

2. Equal Contribution After Necessities

Some couples prefer to calculate rent after accounting for necessary living expenses like food, utilities, and transportation. Here’s how that might work:

- Each person subtracts monthly necessities from their income (or tracks actual expenses).

- The remaining amount is considered “disposable income.”

- Rent is then divided based on each person’s disposable income.

This method takes a bit more work because it requires tracking or estimating living costs, but it can be especially fair when one or both people have significant non-housing expenses.

3. Tiered or Blended Approach

A blended method mixes aspects of equal split and income-based proportional split. For example:

- Split a base amount equally (e.g., $800 each for a $2,000 rent), then have the higher earner cover a portion of the remaining amount based on income.

This can be a good compromise for couples who want simplicity but also recognize income differences.

4. Set Percentage of Individual Income

Another flexible approach is for each person to pay a fixed percentage of their own monthly income toward rent. For instance:

- Person A might pay 30% of their income

- Person B might pay 30% of their income

If Person A earns more, they will pay a larger dollar amount, but both are contributing the same percentage of what they make.

Other Financial Considerations

Rent is just one component of shared living expenses. A fair financial arrangement can also include:

Utilities and Bills

Decide whether to split utilities (electricity, water, internet, etc.) proportionally or equally. Some people choose to handle these expenses similarly to rent, while others might agree to split them 50/50 because they’re less significant.

Groceries and Shared Purchases

Some couples prefer to handle groceries and household supplies jointly, using a shared budget. Others keep separate food budgets. Whatever arrangement you choose, it’s important to agree upfront.

Savings and Emergencies

If one partner has greater financial flexibility, you might discuss goals for shared savings — for example, saving for a vacation, a future home, or emergencies. Clear communication about expectations helps avoid misunderstandings.

Communication and Boundaries

No matter which method you choose, the most important part of dividing rent fairly is clear communication:

- Discuss finances openly. Talk about income, monthly expenses, debts, savings goals, and comfort levels before you move in together.

- Revisit the arrangement. Financial situations change. Reassess how you share expenses if one person’s income changes, or if you decide to move to a new place.

- Respect personal boundaries. Not everyone is comfortable sharing financial details in the same way. Agree on how much information you need to share and what you are both comfortable with.

Approaching the conversation thoughtfully builds trust and prevents resentment over money — one of the most common sources of conflict in shared households.

Conclusion :

Deciding how to divide rent when incomes differ significantly doesn’t have to be a source of stress. While splitting rent evenly might feel simple, it can create an imbalance when one person earns much more than the other. Exploring other approaches — such as proportional contributions based on income, blended methods, or percentage-based contributions — allows both people to share housing costs in a way that feels fair and sustainable.

The key isn’t finding a single “right” method, but rather choosing an arrangement that respects each person’s financial situation, supports mutual comfort, and strengthens communication. Starting the conversation early, being flexible when needed, and being willing to adjust over time will help ensure a stable and healthy shared living arrangement.